Mobile has overtaken every other banking channel. And it’s done it fast.

For product managers and UX teams in financial services, the pressure is on. You’re expected to deliver fast, secure, user-friendly experiences across every screen.

So, how are the best teams keeping up? Read on to find out.

Why does mobile banking experience matter?

In 2024, the global mobile banking market hit $9.63 billion, and it’s expected to more than double by 2032—growing at a CAGR of 11.7%. What started as a nice-to-have in online banking is now the primary interface connecting customers and their finances.

That means your mobile banking experience is your brand. And if it’s slow, clunky, or confusing, customers will switch and move on.

To keep users loyal and engaged, you need to optimize your mobile banking experience. How? By actioning research-fuelled insights.

Our 2025 Future of User Research Report shows just how critical experience design has become:

✅ 87% of Product teams now use user research to inform decisions, not just for usability testing, but for guiding strategy.

✅Teams that embed research early report 2.7x better outcomes, including higher usability, customer satisfaction, and retention.

TL;DR

A great mobile banking experience is built through rapid, continuous insight into how real users navigate your app—what works, what breaks, and what drives trust.

Mobile banking experience trends: What do customers expect?

Users want fast, personalized, and seamless digital experiences. When they don’t get them, your competitors are waiting to help them switch.

Here are the biggest trends shaping mobile banking UX in 2025.

24/7 Access is the baseline

Whether it’s checking a balance at 2am, sending money while commuting, or resolving a failed payment on the weekend, users expect 24/7 access—no downtime, no delays, no exceptions.

According to McKinsey’s State of Retail Banking report, mobile banking touchpoints per customer increased by 72% over three years, surpassing even leading e-commerce platforms in engagement.

Mobile banking is the primary way people interact with their finances.

For Product teams, this means designing mobile banking UX as a real-time system. The back end must be resilient. Status updates must be immediate. Support must be built in. If your app can’t deliver during high-stakes moments, users notice—and they churn.

Digital-first is now the default

For a growing number of customers, banking no longer starts at their local branch—it starts on their smartphone. From opening accounts to applying for loans or checking in money, users now expect to complete every interaction digitally, without needing to visit a physical location.

According to our Customer Experience Banking Trends research, 37% of customers use digital platforms to reduce their reliance on branches, while 23% still prefer in-person service for certain transactions. But here’s the catch: 59% of users rate their mobile banking experience as “average.” That’s an experience gap and a warning sign.

Meeting those expectations means rethinking mobile UX as the primary experience layer—complete, intuitive, and real-time.

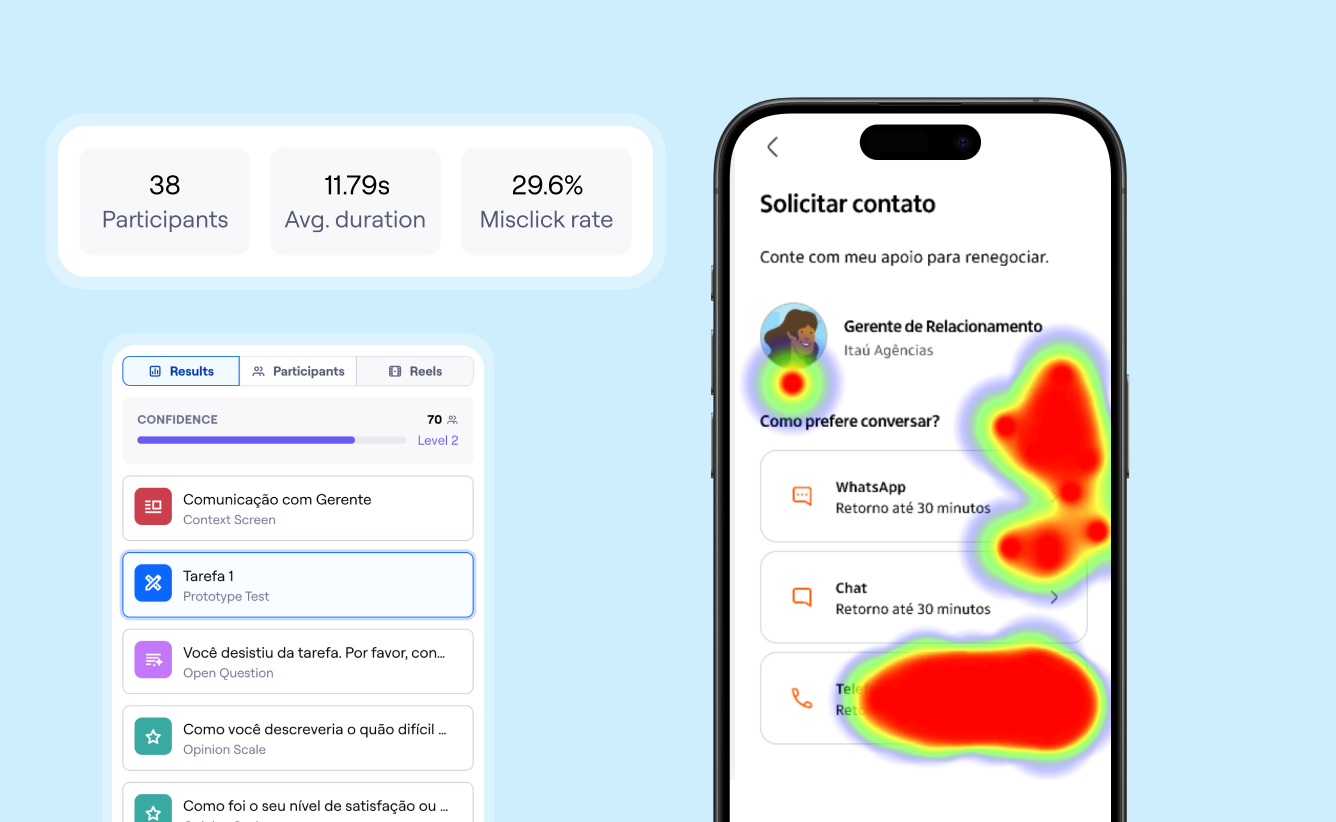

Take Itaú Unibanco, one of the largest banks in Latin America. With hundreds of digital products and millions of users, the team faced a massive challenge: scale usability testing without sacrificing quality.

They used Maze to replace slow, resource-heavy interviews with high-volume, unmoderated testing, cutting time to insight by 75% and growing their annual test count to 500+ studies. Today, over 300 designers and researchers at Itaú use Maze to ensure every digital experience meets a high bar before it ships.

At the start of the year, no one believed it was possible to measure the usability of every mobile experience before delivering it to users. With Maze, we’ve proven it is.

Renato Leite

Lead of CX Research Operations, Itaú Unibanco

Share

Power better mobile experiences

Design, test, and validate every part of your mobile experience with the Maze mobile app—from early prototypes to live app interactions.

Integration of financial wellness tools

Managing money isn’t always easy, and customers are looking to their banking apps for more than just transactions. Increasingly, they want tools that help them understand where their money goes, support in planning ahead, and information on how to make confident financial decisions.

These are financial wellness tools—features that help users save, budget, track spending, and stay on top of bills, by:

- Setting monthly spending limits and tracking progress

- Creating and naming savings goals (like ‘emergency fund’ or ‘new laptop’)

- Getting a simple breakdown of where their money went last month

- Seeing upcoming bills or subscriptions so they’re not caught off guard

- Getting nudges to stay on track when they overspend

But not every tool works like it should—an existing tool doesn’t make a helpful tool. If a budgeting feature is buried deep in the app, requires too many steps, or shows numbers that don’t make sense to the user, it won’t get used. If a savings tracker doesn’t reflect how people manage money, they’ll ignore it.

That’s why continuous research is essential. Dig into real user experiences and discover whether yours users actually use the features available, or what new features they’d like. Teams who focus on understanding their users’ needs and behavior will be faster, more focused, and better at building mobile banking experiences people use.

Not sure if your features are helping or just… there?

Learn how to fix that at Maze University, our free course on running continuous research that leads to better product decisions (and fewer forgotten features).

AI to drive personalization

A few years ago, personalized experiences in mobile banking meant a ‘Hi, Alex’ in your inbox. In 2025, it means your app knows when your rent’s due, reminds you when your subscriptions overlap, and suggests better ways to save—before you even ask.

This is the impact of AI. 70% of financial services executives say AI will directly drive revenue growth, not just improve operations. That shift is happening because AI is powering something users now expect by default: experiences that are personal, dynamic, and useful in real time.

Let’s break down what that looks like in practice:

- Generative AI helps turn raw financial data into clear insights. At Morgan Stanley, advisors use GPT-4 to summarize documents and surface answers faster. For everyday users, this tech powers natural language chatbots that explain transactions, draft spending summaries, or walk users through their next steps—all within the app.

- Predictive models are used by banks like JPMorgan Chase to anticipate user needs based on behavior. These systems flag when a user’s spending spikes, suggest personalized product offers, and recommend goal-based saving plans at the right moment.

- Agentic AI goes further. It doesn’t just predict—it acts. Think automatic categorization of new income, reshuffling dashboard widgets based on goals, or scheduling payments before late fees hit.

Knowing what to personalize and how to do it starts with high-quality customer insights. Embark on getting customer feedback to understand what’s working and what isn’t—before it ends up underused in a corner of your interface.

Best practices in mobile banking experience

So what does a best-in-class mobile banking UX look like in practice?

Let’s get into the tactics.

Simplify UI and workflows

If users can’t complete a task quickly, they won’t complete it at all.

Simplicity is non-negotiable in mobile banking. That means fewer steps to transfer funds, clearer labels on buttons, and frictionless paths to essential actions, such as checking balances, paying bills, or freezing cards. The goal isn’t just ease—it’s confidence.

Usability testing in financial services is key here. You can’t simplify what you haven’t seen people struggle with.

This is especially important across demographics. Some users are power users. Others just want to log in and know where things stand. Designing with both in mind means stripping back unnecessary complexity, chunking flows into manageable steps, and testing relentlessly.

Ensure robust security

Customers want to know their money is safe. But they also expect fast, seamless access to their accounts.

That’s why the most effective security today is quiet, reliable, and user-friendly. Biometric authentication, two-factor prompts, and instant fraud alerts are now standard—but how they’re implemented makes all the difference.

If a user has to enter a 12-character password and a rotating code just to check their balance, that’s not secure banking UX—it’s infuriating UX.

The key is designing security that feels like part of the flow. That includes things like:

- Face or fingerprint login as a default option

- Smart session management that doesn’t log users out too aggressively

- Clear explanations for why certain security steps are required

Balancing trust and ease is a core part of improving customer experience in financial services. And with threats evolving constantly, teams must continuously test how users respond to new patterns, messaging, and alerts.

Provide consistent omnichannel experience

A customer might start on your app, switch to desktop, and finish with a support call. The journey isn’t linear—but their experience should be. Consistency across channels is critical in banking.

That means:

- Making sure flows (like opening an account or applying for credit) don’t force users to restart when they switch devices

- Keeping navigation and language familiar across web and app interfaces

- Ensuring brand consistency in design, copy, and functionality

Strong customer experience strategies treat omnichannel design as a system, not a set of parallel products. That includes shared design systems, cross-platform testing, and user journeys that don’t assume a single screen or path.

It also means looking beyond the UI to test how users actually move through these channels—multichannel and omnichannel testing help teams uncover where continuity breaks and where users drop off.

Prioritize accessibility

A truly great banking app works for everyone.

Accessibility is about building inclusive experiences that serve all users. An inclusive experience features accessible visual, motor, cognitive, and auditory elements that are built into your UX.

In practice, this looks like:

- Supporting screen readers with a clear semantic structure

- Providing high contrast and adjustable font sizes

- Avoiding gestures or UI elements that rely on precision tapping

- Writing in plain language

Designing for accessibility often improves the experience for everyone. What’s helpful for a user with low vision might also benefit someone managing finances on a shaky subway ride. Accessibility should be part of your UX design process from day one, not something tested last.

💡 Want to see what accessibility looks like in finance?

Browse real examples and patterns in our collection of finance UX best practices.

Educate users

As mobile banking features grow more advanced, so does the need for in-app education. That includes onboarding for new features, contextual tips for complex tasks, and timely reminders about security best practices.

This doesn’t mean long tutorials or cluttered help centers. The best banks bake guidance into the flow:

- Microcopy that explains what happens next (‘This transfer will arrive by 6pm today’)

- Tooltips for new features or updates

- Just-in-time nudges about security or account limits

- Links to relevant FAQs when users hesitate or backtrack

Educating users builds confidence, which builds trust. And that trust is measurable. Improving customer experience KPIs—like task success, time on task, and support calls—often comes down to clarity, not capability.

Optimizing mobile experiences with Maze

Improving your mobile banking UX is about testing, learning, and shipping with confidence.

Maze gives Product teams in financial services a fast, scalable way to uncover what users need—and how well their app delivers on it. Whether you're redesigning a login flow, refining a loan application process, or validating a new feature rollout, Maze helps you move forward with real evidence.

Here’s the top applications for Maze in optimizing your mobile app:

Usability testing

Before launching a new product or feature, you need to know that it makes sense to users. Maze offers multiple ways to test usability depending on what you're validating.

- Prototype Testing helps you test early-stage mobile flows like onboarding, transfers, or bill payments—before writing a line of code. You’ll catch friction early, optimize navigation, and validate layout and copy decisions in real time.

- Tree Testing is ideal for evaluating your app’s information architecture. Want to know if users can find ‘Credit Limit Increase’ or ‘Statement History’ without getting lost? This method pinpoints where your menu structure supports—or fails—user expectations.

- Five-second tests let you gauge first impressions on key screens like login, error states, or home dashboards. Do users immediately know what to do next? If not, you’ll see it instantly.

- Card Sorting can help structure financial features in a way that matches mental models. If users are confused about where to find budgeting tools vs. savings goals, card sorting can help you organize content more intuitively.

Interview studies

Sometimes, you need to hear what’s behind the hesitation.

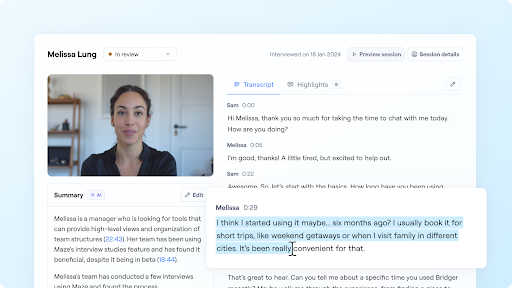

With Maze Interview Studies, you can collect audio and video insights directly from your mobile users, whether they’re opening their first account or managing pensions. These insights are especially powerful for exploring customer experience in financial services: what people expect, what they worry about, and what actually makes them feel in control.

Plus, with Maze AI, you can quickly scan user interview transcripts, capture sentiment analysis, or have AI conduct thematic analysis to highlight key pain points.

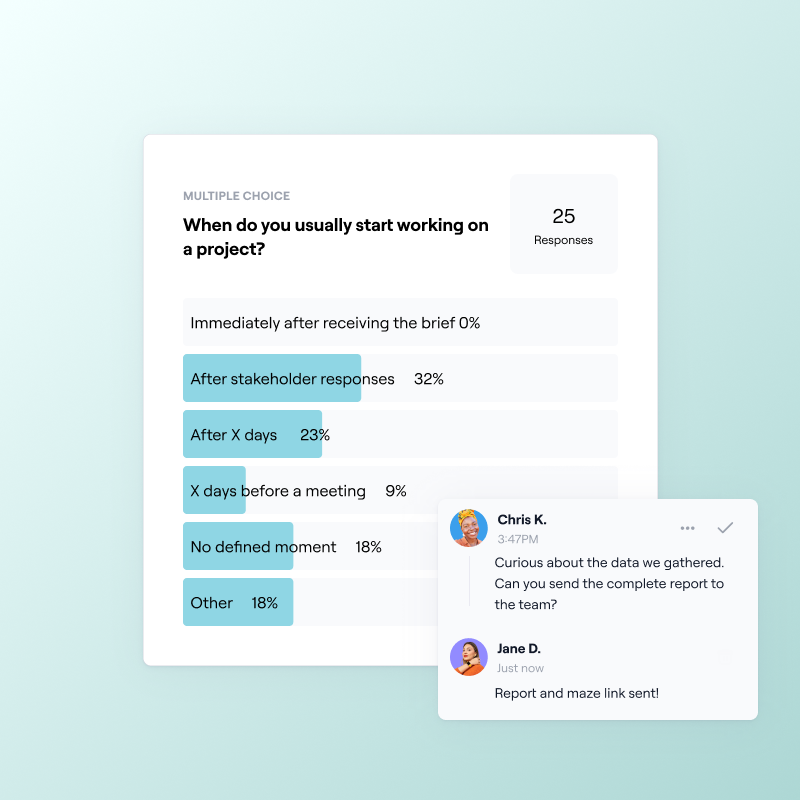

Feedback surveys

The fastest way to improve an experience is to ask users what they want. With Maze’s Feedback Surveys, you can collect sentiment on everything from trust in new security prompts to satisfaction with your budgeting tools.

These are ideal for post-launch check-ins, or even running customer experience surveys that track how users feel over time.

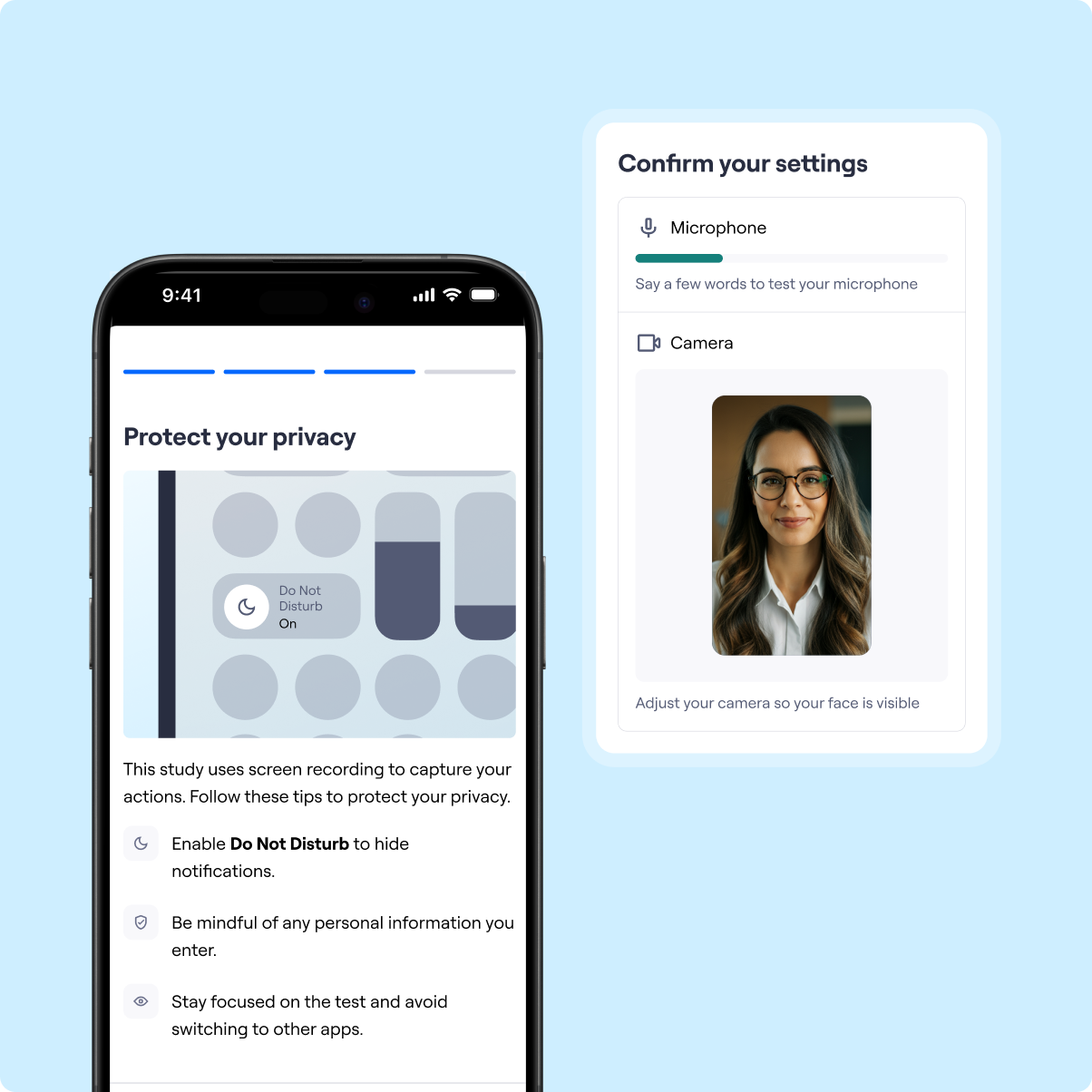

Test live apps on real mobile devices

With Maze’s mobile app, teams can test live product experiences on real devices. That means tapping through full flows, catching real-world friction, and hearing direct feedback while users are actually using your app.

No more testing mobile experiences on desktop. Whether you’re iterating on authentication, onboarding, or notifications, this kind of in-context testing gives you the confidence that your experience holds up when it matters most.

Maze in action: How Vanquis Bank used Maze to build a better mobile banking experience

As more Vanquis Bank customers shifted to digital channels, the pressure was on to deliver a mobile experience that felt modern, intuitive, and trustworthy. But doing that at scale—and with speed—meant rethinking how research was done.

Previously, research meant moderated, in-person interviews at the Vanquis office. But that limited reach, slowed feedback, and left key product decisions unvalidated.

According to UX Researcher Rhys Hicks, “To deliver an app, we needed Maze.”

Since introducing Maze, the Vanquis team has:

- Scaled testing from a local pool to nationwide reach—gathering insights from 1,000+ users on critical mobile flows

- Replaced time-intensive interviews with prototype testing and tree testing that slot right into design workflows

- Used feedback surveys to gut-check changes with live user sentiment

- Built stakeholder buy-in using Maze’s automated research reports and visualizations

Maze has been great for getting the voice of the customer heard. It’s eliminated assumptions and helped us bring real user insights into every meeting.

Rhys Hicks

UX Researcher at Vanquis Bank

Share

From app rebrands to self-serve feature rollouts, Maze became Vanquis Bank’s go-to platform for testing everything—from button copy to architecture—before it hit production.

The result? A mobile banking experience grounded in real behavior, shaped by research, and continuously improving with every release.

The future of mobile experiences in the banking industry

What feels intuitive today might feel outdated tomorrow.

To keep up, you need systems that bring feedback into every decision. Continuous research, real user insights, and a way to test mobile experiences as they’re being built.

With a user testing tool like Maze, you can:

- Test mobile flows across real devices, in real conditions

- Run unmoderated usability tests, tree tests, and surveys at scale

- Capture feedback early—so you build the right thing, not just ship faster

- Make confident decisions that directly improve the app experience and the customer journey

The future of digital banking belongs to the teams that build fast, test often, and listen continuously. With Maze, you’re already lightyears ahead of the competition.

Elevate your research practices

Democratize research across teams, quickly validate product iterations with customers, and move faster than other banks to gain a real advantage.

Frequently asked questions about mobile banking experience

How to improve mobile banking experiences?

How to improve mobile banking experiences?

You can improve mobile banking experiences by simplifying user flows, optimizing for mobile devices, and meeting rising customer expectations with clear design and fast, secure access to key features like transferring money, bill payments, and credit card management.

Who has the best online banking experience?

Who has the best online banking experience?

Chase.com led globally in 2024, with an average of 179 million visits per month, making it the most visited banking site in the world, according to Statista (2025). In the same report, Caixa.gov.br and Acesso.gov.br followed closely, highlighting how digital banking platforms are becoming the primary way customers interact with their bank accounts and manage day-to-day banking services.

In Europe, BBVA was ranked top in Forrester’s 2024 European Digital Experience Review for its mobile app’s user experience, proactive financial tools, and personalized notifications. BBVA’s conversational UI and real-time insights helped streamline complex tasks like transferring money, saving, and accessing customer support, earning it a top spot among mobile banking apps.

Meanwhile, nCino’s Cloud Banking Platform received a 4-star rating from Gartner, standing out among fintech platforms for helping financial institutions modernize the mobile banking experience and respond to rising customer expectations with greater automation and operational efficiency.

What are the challenges in mobile banking?

What are the challenges in mobile banking?

Some of the biggest challenges in mobile banking include:

- Balancing security and a smooth user experience

- Competing with fast-moving fintech innovations

- Meeting high customer expectations

- Ensuring accessibility across all mobile devices

- Delivering consistent, cross-platform app experiences

- Understanding diverse customer needs through feedback